SMART Savings Goals Free Printable for Military Families

This post may contain affiliate links provided for your convenience. We earn commissions if you shop through the links on this page. I am also an Amazon Associate and earn from qualifying purchases Read my full disclosure policy.

This is a sponsored post written by me on behalf of Navy Federal Credit Union. All opinions are 100% mine. Navy Federal is federally insured by NCUA.

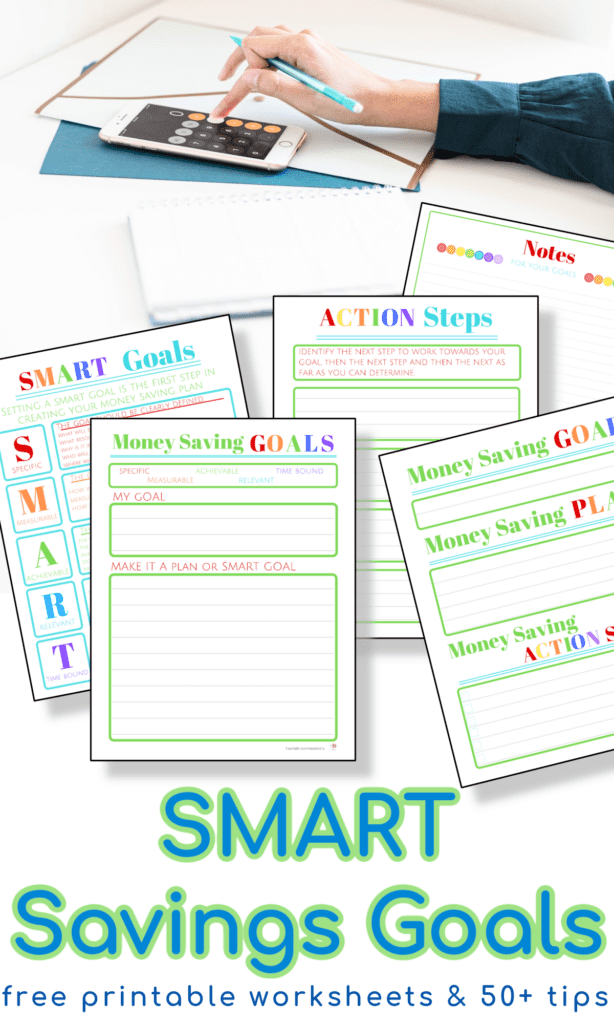

Take control of your finances and your future with this SMART Savings goals free printable and more than 50 tips for military families and anyone interested in saving for their future.

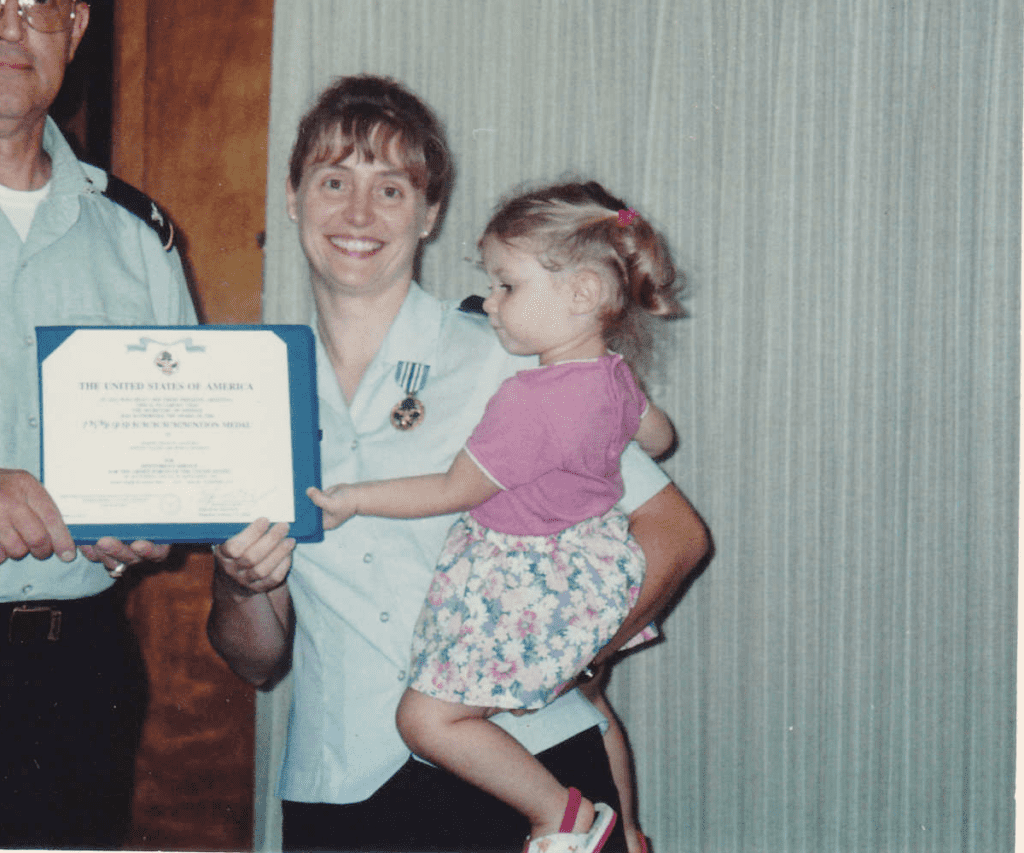

I grew up in a military family and money was tight. My parents were very disciplined with their personal finances and were able to achieve the financial future they wanted. They taught me the skills needed for financial success and it starts with setting smart financial goals.

While I was on active duty and now as a military spouse, I’ve also been very disciplined with my financial goals. By focusing on financial responsibility and savings, my husband and I have been able to reduce stress, provide a stable life for our family and save to achieve our goals.

Being disciplined about savings really is the best way to achieve the financial security you want.

When you are purposeful and focused with your savings, it provides financial stability and flexibility. You can reduce stress and increase your control over your life decisions. Who doesn’t dream of a less stressful life with more freedom?

How Do You Create a SMART Financial Goal?

Many people set goals that are actually wishes or dreams versus actual goals. “I want to be rich” is a dream, but “I want to retire at age 50” is a goal.

The SMART goal format outlines the steps necessary to set a goal that is achievable and guides you in creating a plan to reach that goal.

A SMART goal has five parts. It is:

- Specific – It is a precise, clear goal

- Measurable – The goal can be measured in time and amount

- Achievable – It can be reached with focus and work

- Realistic and relevant – It can be reached within the limitations of time and resources and corresponds to your personal life goals

- Timebound – There is a set deadline to accomplish the goal

Examples of Financial Goals

Financial goals can be short-term goals, intermediate goals or long-term goals depending on how long it will take to accomplish. You should carefully choose your own personal goals, but this is a list of common savings goals:

- Create an emergency fund – for unexpected situations such as losing your job or unexpected medical costs

- Pay off debt, especially credit card debt and high-interest debt

- Save for a child’s college education

- Save for the down payment on a house

- Establish a sinking fund (i.e. savings towards a short-term goal like Christmas gifts)

- Save for retirement

- Create a rainy day fund – for unexpected expenses such as an appliance repair, car repair or replacing a lost cell phone

- Cover healthcare costs

- Save for a car, boat or RV purchase

- Save for home improvement projects

- Take a vacation

- Start a business

SMART Savings Goals

Once you establish your SMART savings goal, the next step is to create your savings plan.

To outline your savings plan, you need to:

- Determine how much you will save daily, weekly or monthly towards your goal.

- How much do you want to save?

- When do you want to have it saved?

- Will it be easier for you to track your savings by the day, week or month? Most people find weekly or monthly savings goals easier to manage.

- Divide the amount you want to save by the number of savings periods (weeks or months) and this is your weekly or monthly savings target.

- Determine how you will save this amount each period.

- Determine where you will keep your savings. In a savings account, money market account, IRA or other.

Start saving!

Simple ways to save

Look for ways to save and be purposeful in putting the savings into your designated account.

1. Create and stick to a budget. You can use my free 7-page budget planner to get started.

2. Find an accountability partner or group of savings focused people for support. Military families can take the Military Saves Pledge and take advantage of the wealth of resources and support to help you reach your savings goals. The top 3 goals of other people taking the pledge last year was to set up an emergency fund, general savings and save for a house. Taking the Military Saves Pledge, is a great way to find encouragement, share savings tips and and join a community of people who are dedicated to establishing healthy savings habits.

3. Pay bills on-time and in full each month to prevent late fees and other charges. This also helps positively build your credit history.

4. Set up auto-pay for bills so you never forget or miss a payment. This is particularly helpful for military families dealing with deployments and PCSs.

5. Put your tax refund towards your savings goal.

6. If you can afford to, try to pay more than the minimum on your monthly credit card or loan payments. This helps you save on interest and pay down your debt faster in the long run.

7. Cancel subscriptions. Chances are you’re paying for many different types of subscriptions. Cancel the ones you’re not using and reduce similar subscriptions to just one (do you really need all those streaming services?).

8. Use the library for books, music and movies. Many libraries offer streaming and online resources for free.

9. Military families can shop and save at the Exchange and Commissary. Pay attention to the amount you save and place it your savings account. Do the same when you shop at discount stores or purchase an item on sale.

10. Look for savings accounts and IRAs with the best rates and even bonuses. Navy Federal offers members a $50 bonus when you open your first IRA with them (offer expires April 30, 2022). I personally have several different types of accounts with Navy Federal and appreciate their service and support for military families. Saving with Navy Federal, coupled with their generous bonuses and rewards, has helped me achieve several financial goals and move me closer to the savings goals I’m still working towards.

11. Meal plan. Don’t waste money throwing out expired food or eating out at the last minute. When you meal plan, you consume what you purchase so food (and money) doesn’t go to waste. If you don’t already meal plan, you’ll find my top tips for family meal planning helpful.

12. Always shop with a grocery list that coordinates with your meal plan. This reduces impulse shopping. Take time to review the sales; then stock up on items you use often and meal plan around the sales.

13. Set a gift budget for family, friends and other gift giving situations and stick to it. Lower the original gift budget you set, even by 5%.

14. Many stores and services offer military families and veterans a discount when you show your military ID card. Before you make a purchase, ask if they offer a military discount.

15. Unsubscribe from promotional emails that tempt you to impulse shop with sales notifications.

16. Reduce how often you eat out for lunch and for dinner. Pack your lunch. Cook a homemade or store-bought pizza instead.

17. Use savings apps, coupons and store rewards programs to save on necessary purchases.

18. Do your own hair, nails, eyebrows, and lashes . Contribute the savings to your goals.

19. Shop thrift stores, consignment sales and yard sales. Bank the savings.

20. Cancel memberships, such as gym memberships, and look for free alternatives.

21. Review your insurance coverage and rates. Shop around for better rates.

22. Set up automatic deductions for your savings. When you save automatically, you’re more likely to stick with your savings plan.

23. Look for free community activities for your family on the weekends rather than paying for entertainment.

24. Make the temperature in your home work for you. Lowering your thermostat in the winter and raising it in the summer just a few degrees can help you save money. Lower the heat at night in the winter to save more. Set your hot water heater to 120F and save even more.

25. Quit an expensive habit. You know the one.

26. Use a reusable water bottle instead of purchasing water bottles.

27. Establish an errand day each week to save gas. Group errands together by location and plan your route to save even more.

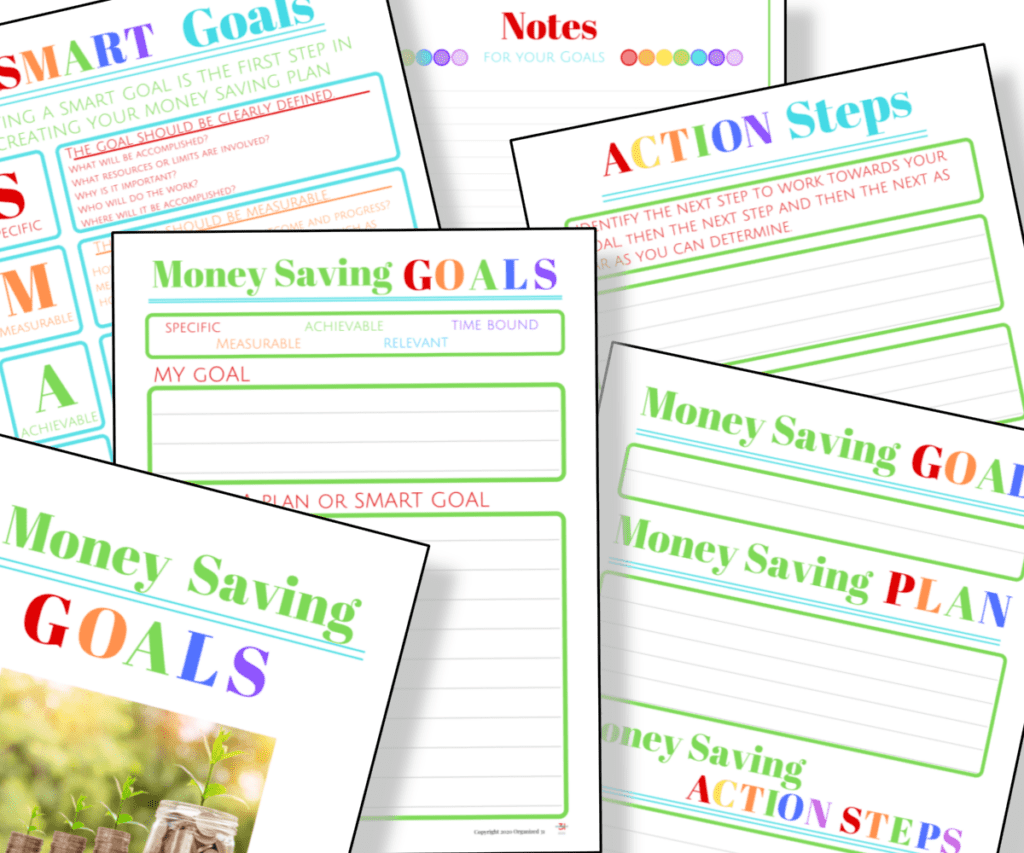

What you need to print the SMART Savings Goals Worksheet

- The SMART Savings Goals worksheet – Get it for free when you sign up for our free exclusive content below.

- Printer

- Printer paper

- Access to your financial accounts, monthly budget or current information

- Pencil

- Calculator

To get your free SMART Savings Goals Worksheets, simply sign up for our free exclusive content below. You’ll receive immediate access to printable savings worksheets pdf and will have access to all exclusive content on Organized 31, which includes hundreds of printable resources.

Download your free copy of the SMART Savings Goals worksheet.

You can print this printable pdf as many times as you’d like for your personal use. All printables are copyrighted.

Join me this month to:

- Set a goal.

- Make a plan.

- Save Automatically.

Be sure to pin this SMART Savings Goals worksheet so you can find it each time you’re ready to set new money goals.

I’m a mom of 3, a veteran, military spouse. I’ve moved into 20+ homes all around the world. My passion is helping busy people make the space and time for what’s really important to them. Learn more about Organized 31 and me.