25+ Tips to Organize Finances

This post may contain affiliate links provided for your convenience. We earn commissions if you shop through the links on this page. I am also an Amazon Associate and earn from qualifying purchases Read my full disclosure policy.

This is a sponsored post written by me on behalf of Navy Federal Credit Union. All opinions are 100% mine. Navy Federal is federally insured by NCUA.

Take control of your money, your financial records and safeguard your financial information with these 25 tips to organize finances. Purposefully managing your money is one of the biggest impacts you can have on achieving your personal goals.

I’ve always been extremely organized when it comes to all aspects of my finances. It started when I first joined the military and had to monitor my financial situation while deploying and has continued through becoming a small business owner. Whatever your situation, it’s always a good idea to organize all areas of your finances.

Why should I organize my financial records?

Create the financial life you want and achieve your financial goals.

Organizing all aspects of your finances is the first step in taking charge of your financial health and future. You will know and understand your money, your financial situation, all of your financial accounts, your expenses, and all the details you need to make financial decisions.

This knowledge allows you to make the best decisions for your goals and situation rather than just reacting to events or even neglecting important decisions and tasks.

Help you achieve your money goals.

Whether your goal is to improve your credit score, establish an emergency fund, pay off debt, start a business or something else, it’s critical to know, track and make responsible decisions regarding your finances. A financial organization system allows you to track your expenses, income and important information.

Secure your financial documents, bank accounts and information to reduce the risk of being scammed.

The incidence of financial fraud and scams have been increasing. Organizing your financial information is a critical step in protecting yourself. When you’re organized you can:

- More quickly identify and report credit card or debit card fraud.

- Know the proper steps to take to protect your digital information.

- Be familiar with your accounts and bills so you’re less likely to fall prey to phishing scams and wire fraud.

- Become more alert about all aspects of your finances so that you can better protect yourself.

Navy Federal Credit Union has created an in-depth resource with information and simple steps you can take to protect yourself from fraud and scams. It’s important to keep informed on the newest frauds since the scammers’ techniques are always evolving. I frequently check this comprehensive resource to protect my own finances.

Navy Federal also provides state-of-the-art fraud prevention systems for their members. As a Navy Federal member myself, I’ve seen these systems in action over the past decade. I’m notified of suspicious activity on my accounts and kept informed on the newest fraud protection practices so I feel secure banking with them.

Give you peace of mind and reduce stress.

When your finances are organized, you no longer dread opening the mail or emails. You’re no longer surprised by late fees, penalties or a lack of funds in your accounts. Having all the information you need to take control of your financial obligations allows you to direct your future and that brings an invaluable peace of mind.

How to Organize Finances

There are many aspects to organizing your finances. These are some of the easiest ways to get organized quickly.

Always work with your spouse or partner on budgeting and financial organization. You must work together to set and achieve financial goals for them to work.

Coordinating with a business partner is also critical in managing small business finances.

Create a Financial Routine

Design a routine that works for your financial needs and your schedule. When you establish a routine, you acknowledge that managing your finances is important and you commit to continually taking the steps necessary to achieve your financial goals.

Your routine gives you the structure to make sure you take care of all financial tasks every month. No more forgetting to pay a bill or forgetting to check the balance on your account.

Read statements and bills

Open and read bills when they arrive so you can immediately address any discrepancies. If there are no issues, you can put the bills aside in a designated fling system until your scheduled finance day.

Schedule time to read all statements and bills at least monthly. The best way to stay on top of bills is to handle them the same day each week. Saturday or Sunday is a good time for most people. Schedule 30 minutes to an hour each week on your calendar to take care of all money related tasks.

Pay bills on-time

- Bill paying is a key part of your financial routine.

- To stay on top of all your bills, have one main list of all bills, due dates, amounts and how the bill is paid.

- The easiest way to never be late is to pay it the day or week you receive it.

- Automate your finances. Take advantage of online banking to set up automatic bill pay. This is the most efficient way to make sure your bills are always paid on-time. It’s simple to set up automatic bill payments. On-time payments mean you won’t pay late fees or interest, which contributes positively to and will protect your credit score.

Use Direct Deposit

If you haven’t already, set up your paycheck and other income to be directly deposited to your bank account. Consider having it deposited to your savings account and then transfer only the amount you need or have budgeted for monthly expenses to your checking account.

Taking that extra step of transferring an amount from your savings to your checking for you to be able to spend it can help reduce impulse spending. This is an easy way to save a little extra each month.

Direct deposit can come with other perks too. For example, Navy Federal members can earn 1.75% cash back on all purchases with a cashRewards credit card with direct deposit set up at Navy Federal, among other benefits.

Set Up Budget Reminders

Your financial organization and financial success requires continued periodic review and maintenance. These are financial habits that need to be maintained for the long run.

Schedule time weekly to review:

- That week’s spending habits. This allows you to quickly make adjustments, if necessary

- Your accounts so you can identify any suspicious charge or activity and address it promptly.

- Bills and financial statements that have arrived in the mail. This allows you to pay them or file them right away so they don’t get misplaced.

Schedule time on a monthly basis to review:

- Monthly bills and pay them if you haven’t set up auto pay.

- Utility bills for any discrepancies. This is how we found out last year that we had a water leak that needed to be repaired immediately. It also allows you to adjust your budget as needed for utilities during these times of inflation.

- Investment accounts and all bank account statements. This keeps you up-to-date on the information you need for your budgeting tool and helps you identify any fraudulent discrepancies as soon as possible.

It’s important for both personal and business finances to schedule an annual review of:

- Your financial goals.

- Your budget and make changes for the new year based on life and financial changes.

- Your savings and investments.

Many people find tax season a good time to examine the past year and make adjustments to financial goals since you’re already gathering all your financial data.

Keep bills and financial documents in one location

Many people lose track of their financial information and miss paying bills on-time because they don’t have an established filing system. Creating an easy-to-use filing system is critical for both paper records and digital documents. The habit of filing documents is more important than whether you choose to use physical or digital files.

Have a filing system for all financial information

You should have short-term working files and long-term reference files.

Working files hold bills that need to be paid and financial statements until you update your budget. Once these statements have been addressed, they can be moved to your long-term reference file. If you’re not sure how long to keep documents, my article will help you decide what’s best for you.

Your reference files should contain everything you need to file your taxes and for the future sales of assets. Check with your financial advisor or tax advisor for your specific needs.* (*This information is intended to provide general information and should not be considered tax advice. Please consult a tax professional for more information.)

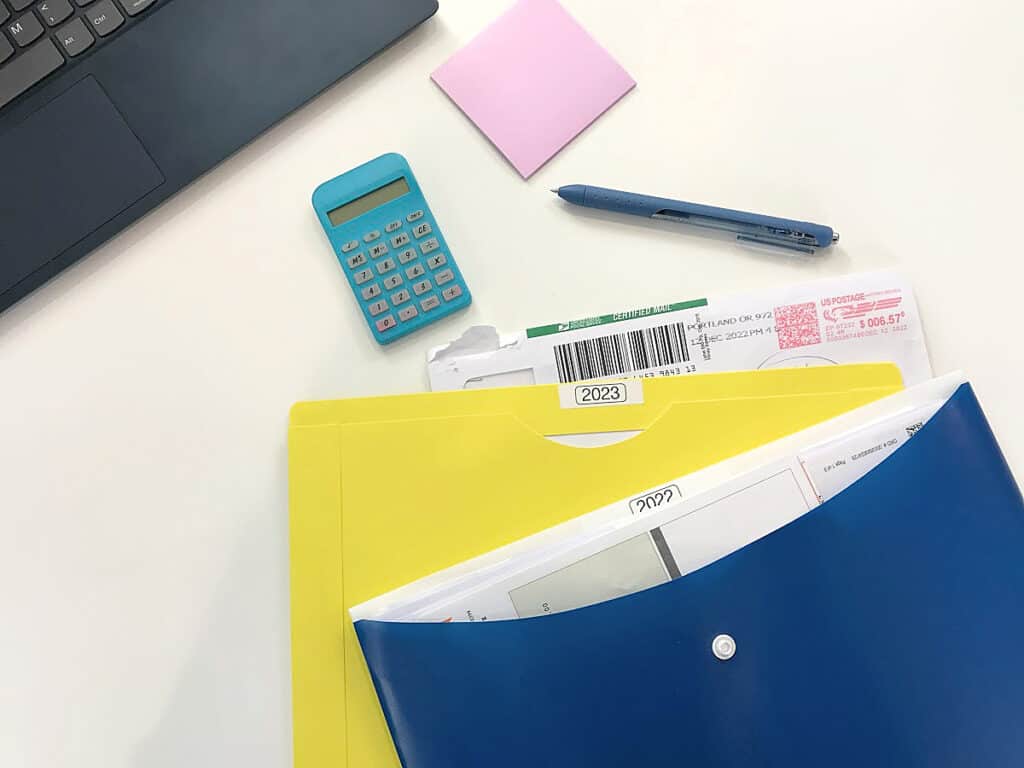

I recommend keeping a dated file folder for each new year in a central location. Place all tax related documents and receipts in the folder throughout the year. This makes tax time much easier since you’ve already gathered the pertinent documents in one file.

I’ve personally been doing this for decades and recommend it to my clients. It’s a simple way to get organized that saves a whole lot of stress each tax season.

Protect Your Information and Accounts

It’s much better to proactively protect your finances and personal information than to play clean up after you’ve experienced a financial scam. I know firsthand because I was a victim of a identify theft many years ago. The scope of the theft was small, but the amount of work it created for me was large. Trust me, take the time now to protect yourself and reduce your exposure to financial scams.

Strong Passwords

You know that you’re supposed to have strong passwords, but I bet you haven’t been as diligent as you should be. Now is the time to protect yourself by creating the best passwords you can. A strong password should:

- Only be used once. Don’t use the same password for multiple accounts.

- Be longer to make it more difficult to crack.

- Should contain a mix of characters.

- Include both upper case and lower case letters.

- Include numbers.

- Include special characters.

- Don’t use easy to find personal information in your password such as:

- Your name

- Names of family members or pets

- Your birthday

- Parts of your address

- Your email address or login name

It’s helpful to create a sentence and then use the first letter of each word in your sentence for your password. Mix in numbers and special characters in a way that makes sense to you. it’s much easier to remember a sentence than a mix of random letters.

Secure your passwords

Once you create strong passwords, they’ll be more difficult to remember. You’ll need to keep track of all your new logins and passwords. Use a quality online password vault or a physical password book that you keep in a safe place. Be diligent about securing a physical password book.

USE Secure internet

Make sure you only log into financial accounts when you’re on a secure internet connection, not public or unsecured networks. Scammers count on people being lazy in using public Wi-Fi and they’ll take advantage of you.

Shred documents

Even if you choose to receive online bank statements to minimize the paper documents you receive, you may still get financial documents in the mail. Protect yourself by conscientiously shredding personal financial information if you don’t need it anymore.

Have a Budget

Creating and maintaining a budget is key to being in control of your money. There are many different budgeting strategies, so you can choose the one that works best for your needs:

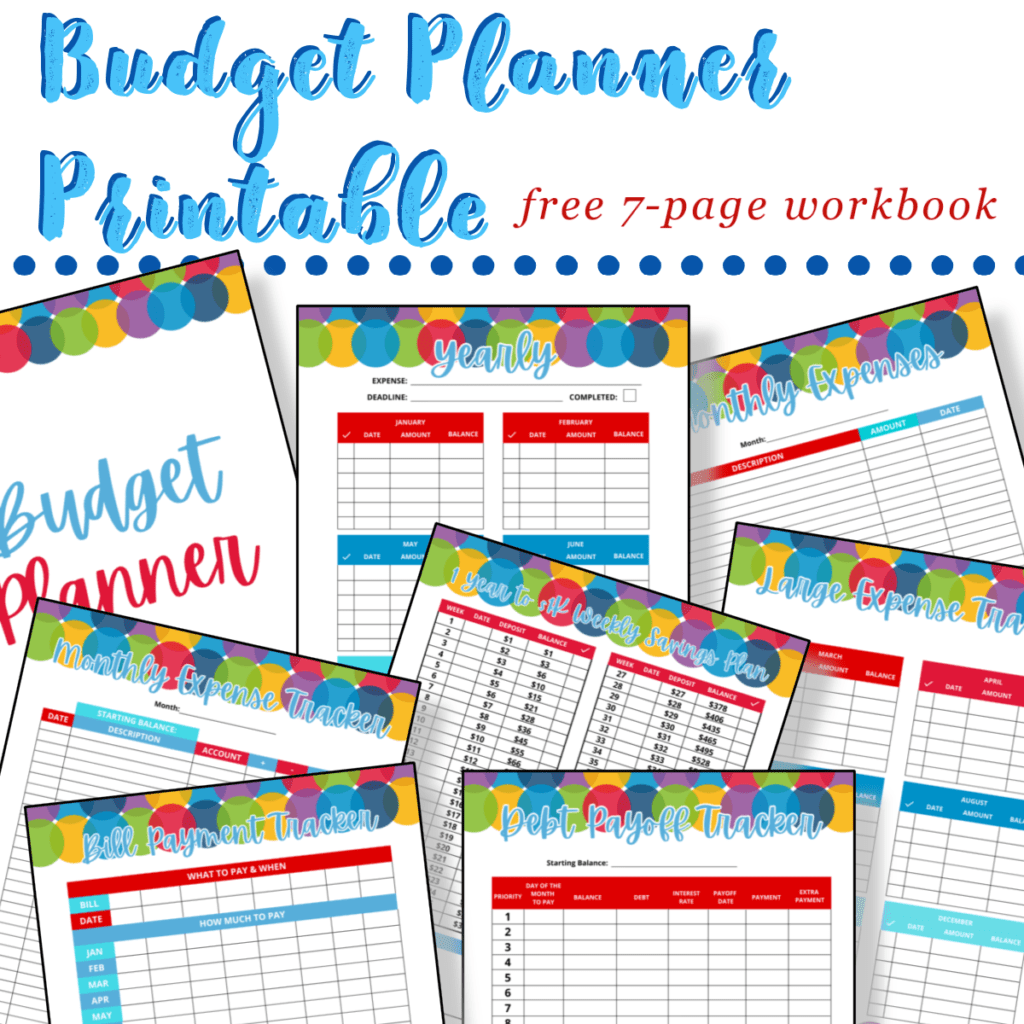

- Traditional budgeting tracks income and expenses using a monthly budget planner. This is a popular budgeting method. You can use my free 7-page budget planner printable to get started.

- 50-20-30 Rule budgeting distributes income with 50% for needs, such as rent and food, 20% for savings and paying off debt and 30% for wants, such as travel and entertainment.

- 70-20-10 Rule budgeting allocates income with 70% going towards bills and needs, 20% going to savings and investment, and 10% going to debt and donations.

- Reverse budgeting sets your budget based on your specific goals. For example, if you want to payoff a car loan, you budget paying an extra $100 or more a month on top of the regular car payment and then allocate the remaining income for other bills and expenses.

Track spending & Income

The foundation to any budgeting strategy is to be aware all income and expenses. If you don’t know what you have coming in and going out, you won’t be able to make good decisions. Be thorough and honest in monitoring all expenses so that you can create an accurate and useful budget.

Review your budget regularly

Budgets need to adapt as your life changes. Schedule a date quarterly or at least every year to closely examine your budget and changes to income and expenses. Make adjustments to your budget so it best serves your financial goals and reflects your current situation.

Looking for more help organizing finances?

SMART Savings Goals Printable – Save for the future you want with this 6-page SMART Savings Goals free printable worksheet & 50+ tips for military families and everyone.

Free Budget Planner Printable – A 7 page free budget planner printable you can download immediately to create your own or a family budget with a simple, straightforward plan.

Tickler File System – Staying on top of finances, paperwork and life is much easier with this Organized 31 Tickler File for paper and task management.

Find all our best organizing tips in the table below. You can scroll though the table and look for ideas or search for specific ideas with the magnifying glass in the upper right-hand corner (on desktop). Click on the topic and then click through the specific article.

I’m a mom of 3, a veteran, military spouse. I’ve moved into 20+ homes all around the world. My passion is helping busy people make the space and time for what’s really important to them. Learn more about Organized 31 and me.